Transform Your Child’s Future With Strategic Trump Account Investing

-

Imagine turning a government account into a tax-free fund for your child's future. By converting these "Trump Accounts" into Roth IRAs when they turn eighteen, you can lower taxes and build significant savings for their financial security.

So, if you're a parent or grandparent wanting to boost your child’s finances, a new option called the Trump Account — created under the "One Big Beautiful Bill" — can transform family investing. These accounts work like traditional IRAs but allow you to grow wealth without the usual income requirements.

What Exactly is a Trump Account?

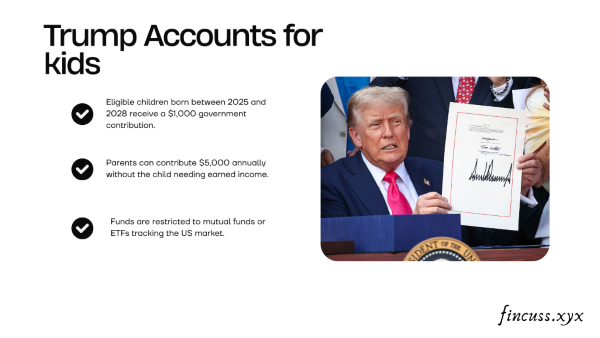

These are government-funded, tax-deferred investment accounts designed to jumpstart a child's financial future. Here are the core facts:

• The Seed Money: Children born between 2025 and 2028 receive a one-time $1,000 deposit from the U.S. Treasury.

• Annual Contributions: Guardians can add up to $5,000 per year (indexed for inflation).

• Investment Focus: Funds must be placed in diversified ETFs or mutual funds tracking U.S.-based companies.The "Traditional" Trap

By default, these accounts function like a Traditional IRA once the child turns 18. This means:

- You do not receive a tax deduction for contributions.

- The child is taxed on every penny taken out during retirement.

- Early withdrawals before age 59.5 often trigger a 10% penalty.

The 4-Step Expert Strategy to a Tax-Free Life

To avoid heavy taxes, you can "flip" the account into a Roth IRA. According to the sources, here is how to build a potential $8.8 million tax-free nest egg:

1. Establish the Account: Starting July 5, 2026, set up the account via trumpaccounts.gov or your bank.

2. Maximize Contributions: Aim to contribute the full $5,000 annually until your child turns 18. Over time, a total investment of $60,000 could grow significantly.

3. Execute the Roth Conversion at 18: When your child turns 18, convert the Traditional IRA balance into a Roth IRA.

4. Use the "Chunking" Method: To pay zero tax on the conversion, move the money in stages. By staying under the standard deduction (the amount of income you can earn tax-free), your child can convert thousands each year without owing the IRS a cent.

Final Thoughts

While the Trump account provides a great "seed," the real magic happens through compound interest and strategic tax planning. A Roth IRA allows your child to keep all their withdrawals without the government taking a cut. It is a powerful way to ensure your kids are set up for life.